Twice a year, the Student Administration System flags accounts due to discrepancies with Social Security Numbers (SSN). The University's records indicate that either:

- The student did not provide a social security number (SSN) or individual taxpayer identification number (ITIN) to UConn; OR

- The SSN or ITIN information that was provided to UConn was inaccurate or contained errors; OR

- The name in the SAS does not match the name on the social security card.

The University requires this information be accurate when preparing important tax forms that are required by federal law, including forms that help determine eligibility for certain tax deductions and credits. Please also keep in mind the University is required by law to request this information, and the student is required to provide it, regardless of age or filing status.

Note: Foreign nationals not eligible for an SSN or an ITIN may indicate this when completing the Update Social Security Number Request in StudentAdmin.

The process of updating requested SSNs has moved to StudentAdmin. It is entirely online, and students must complete it by themselves. This process no longer goes through the Form W-9S and forms will no longer be accepted.

How to respond to the solicitation

How to respond to the solicitation

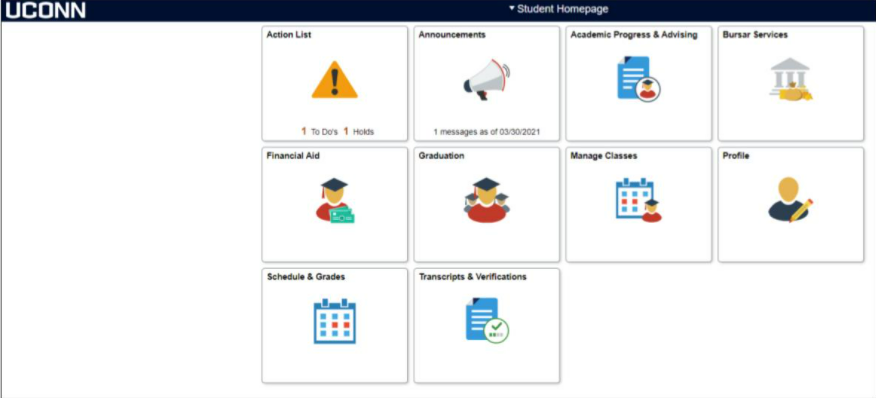

Log in to the Student Administration System with your UConn NetID and password. To find your NetID or to reset your NetID password visit the NetID website or call the Technology Support Center at 860.486.4357.

Click on the task in your Action List titled “Update Social Security Number Request”. You will be walked through the process screen-by-screen.

Again, please note that the University can no longer accept this information via FileLocker, hard copy form, email, or telephone.

I am an international student and do not have an SSN or ITIN. What should I do?

I am an international student and do not have an SSN or ITIN. What should I do?

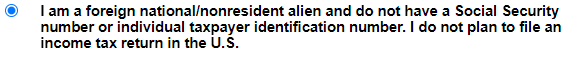

Please still complete the To-Do. You will be able to select a button that indicates you are an international student who does not have an SSN or ITIN.

If you indicated that you are an international student who does not have an SSN or ITIN, and then you obtain an SSN or ITIN:

Please submit a Biographical Information Update Request Form and return it to One Stop.

Please note when returning the form to them that email is not a secure method for transmitting a social security number. One Stop can be reached at onestop@uconn.edu or 860-486-1111 with questions.

I entered in my SSN correctly but received an error message that my SSN or ITIN is invalid. What do I do?

I entered in my SSN correctly but received an error message that my SSN or ITIN is invalid. What do I do?

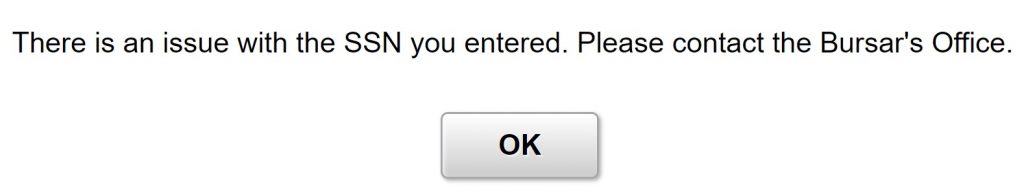

If you received this message, you may have clicked “Save” twice.

If you entered your SSN and then received this message, please follow these steps. Your SSN will remain saved in the system. You will just need to do as follows to complete the process.

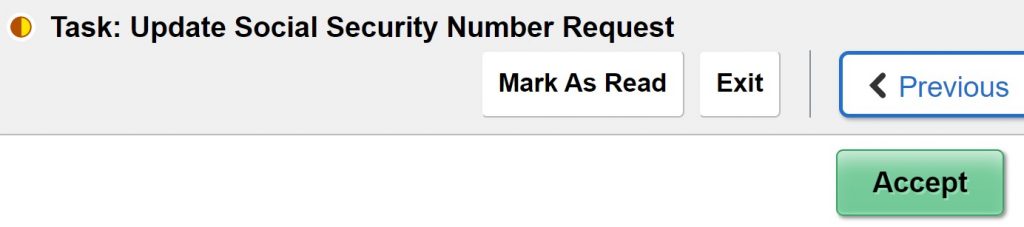

1. Click “Mark As Read”.

The “Mark As Read” will disappear and a “Next” button will appear.

*Please see below if you do not have a “Mark As Read” button and cannot proceed.

2. You should then click the “Next” button.

3. The rest of the steps are very easy! You need to click “Accept”.

4. Then “Next” again.

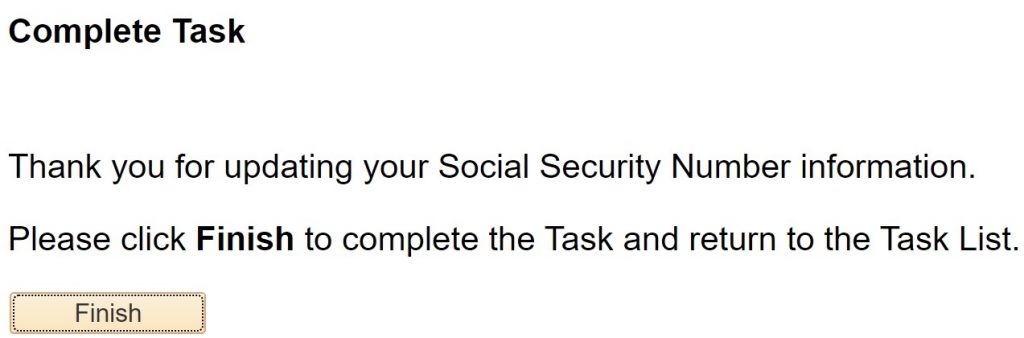

5. Then “Finish”.

*If you do not have a “Mark As Read” button and cannot proceed:

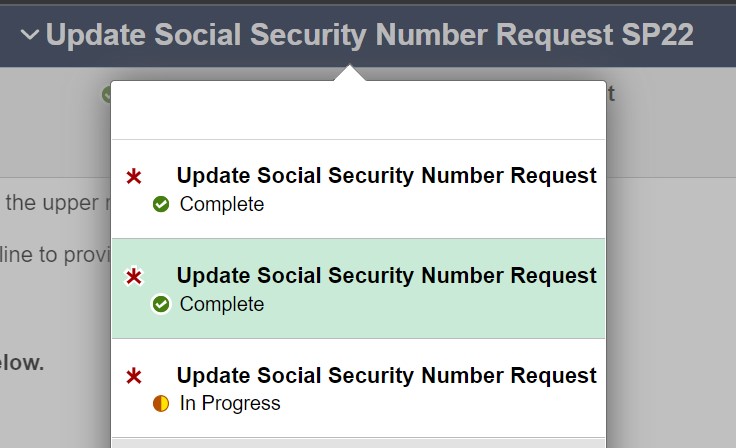

Go back into the Update SSN task. Click on the heading of the task, “Update Social Security Number Request”.

Once you click the heading, a dropdown menu will appear, showing the steps available to you. You can switch between the different steps by clicking on them.

To proceed, simply click on the next step. You will not need to use the Mark as Read button to do so.

This article covers accessing your Update Social Security Number Request task.

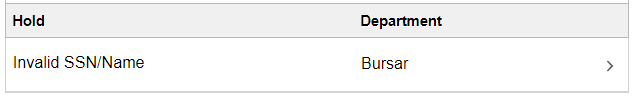

I noticed I also have a hold on my account that says I have an Invalid SSN/Name. How can I remove this hold?

I noticed I also have a hold on my account that says I have an Invalid SSN/Name. How can I remove this hold?

If you complete the To-Do in the Student Administration System and provide an SSN or ITIN, your hold will be removed within 1 day.

If you complete the To-Do in the Student Administration System and do not provide an SSN or ITIN, your hold will not be removed.

However, this hold is just a note on your account that we do not have an SSN or ITIN on file for you. This hold does not impact your ability to register or access any UConn services. Again, it has no impact on your ability to do anything at UConn and is just a message on your account.

Walkthrough from IT

Walkthrough from IT

Here is an additional walkthrough created by IT. Please review this walkthrough if you are encountering issues.

https://kb.uconn.edu/space/SAS/10946642239/Updating+Social+Security+Number+Request+Task